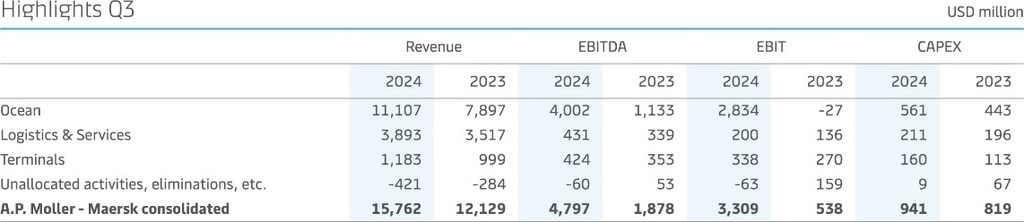

Maritime News : Copenhagen, Denmark – A.P. Moller – Maersk has announced impressive results for the third quarter of 2024, showcasing robust growth across all business segments. The company’s financial performance significantly outpaced that of the previous year, primarily driven by its Ocean segment, while Logistics & Services and Terminals also contributed positively.

Significant Growth Across Business Segments

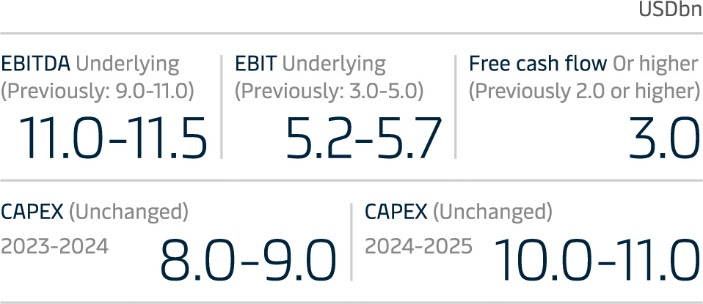

Maersk reported an underlying Earnings before interest and taxes (EBIT) guidance increase for 2024, now expecting between USD 5.2 to 5.7 billion, up from a prior estimate of USD 3.0 to 5.0 billion. This revision reflects strong market demand and ongoing challenges in the Red Sea region.

CEO’s Commitment to Profitability

Vincent Clerc, CEO of Maersk, emphasized the company’s commitment to navigating market volatility. “This quarter, we reaffirmed our commitment to profitable growth and operational progress, driving results across all business areas,” Clerc stated. The focus on cost discipline and productivity improvements has been pivotal in this achievement.

Vincent Clerc, CEO of Maersk, emphasized the company’s commitment to navigating market volatility. “This quarter, we reaffirmed our commitment to profitable growth and operational progress, driving results across all business areas,” Clerc stated. The focus on cost discipline and productivity improvements has been pivotal in this achievement.

Ocean Segment Sees Revenue Surge

The Ocean segment experienced a remarkable 41% increase in revenue, bolstered by higher freight rates and positive volume growth. Despite cost pressures from network re-routing and bunker consumption, operational efficiency led to an EBIT of USD 2.9 billion and a margin of 25.5%.

Logistics & Services Show Steady Growth

In Logistics & Services, Maersk reported an 11% year-on-year revenue increase and a 7.2% sequential growth. The segment achieved an EBIT of USD 200 million, a year-on-year rise of USD 64 million, primarily driven by gains in Lead Logistics and Air services.

Terminals Achieve Record Performance

The Terminals segment saw substantial growth, particularly in North America. Revenue per move hit record levels, contributing to an EBITDA of USD 424 million, the highest since Q1 2022, and a return on invested capital (ROIC) of 13.0%.

Upgraded Financial Guidance for 2024

On October 21, Maersk raised its financial guidance for 2024, now projecting global container market growth of around 6%, up from the previous 4-6% forecast. The company’s CAPEX guidance remains unchanged.